Victorian electricity insights

Large-market

The wholesale prices in Victoria are still relatively low in comparison to the rest of the country, with a recent lull in the last month evident in chart, courtesy of ASX Energy.

With power prices expected to climb, it's a good time to look at fixing in your next large-market contract for the next 2-4 years through forward-contracting options.

Source: VIC Base Cal Futures, source: ASX Energy, 14 June 2024

Small-market

For businesses on small-market contracts, there are some key initiatives and changes you should be aware of:

The ‘Victorian Default Offer’ (VDO), set by the Victorian energy regulator, has been announced, set to raise business energy rates up to 25% over the next few months. Your business should receive a rates increase notice from your current energy supplier. You are then encouraged to shop around or work with a group like Choice Energy who can run your expert energy comparison for you. Read about the VDO increases here.

As part of the Federal Government’s energy bill relief, eligible small businesses in Victoria will benefit from a $325 rebate. Read about it here.

New South Wales electricity insights

Large-market

The Liddell Power Station based in the Hunter Valley Region, closed at the end of April after 50 years of operation.

Wholesale energy prices in New South Wales have continued upwards as we anticipated in our blog before the closure. Now that winter has set in, this adds additional supply and demand pressures onto the grid.

Source: NSW Base Cal Futures, source: ASX Energy, 14 June 2024

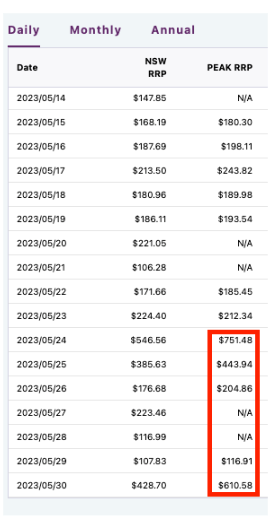

Volatility was evident in May as spot prices reached $750 / mWh indicative in the graph below.

As reported in the Australian Financial Review, Snowy 2.0 has been delayed for two more years and won’t be ready until 2029. Warnings have been triggered about potential blackouts and higher prices as coal power plants retire, adding to the threat of supply shortages in renewable transition.

According to NSW Energy Minister Penny Sharp, “The delays also mean there is the need for close and ongoing discussions between Origin and the government about the pending closure of Eraring,”

“The NSW government has made it clear, we will not allow households and businesses to not have enough energy. We will explore every option to keep the lights on as the NSW electricity system adapts and transitions.”

Read more on the AFR: “Power worries grow as Snowy 2.0 finish date blows out”

Wholesale prices are expected to continue upwards as we await for new energy sources to come online. If you are coming out of contract within the next 6-12 months, it's a good time to look at what contract options are available to you. Depending on rates and your unique situation, a shorter contract length may be advisable.

Besides this, if your energy usage has changed within the last 6-12 months because you’ve switched to commercial solar or you have recently installed a new piece of equipment, we encourage you to have a network tariff and demand assessment performed to ensure you are on the most appropriate network tariff. These costs can account for up to 60% on your large-market energy bill, and they are negotiable. Learn more.

Small-market

Small businesses in New South Wales face average increases of up to 21.6% depending on the network distribution zones that your business operates in. If you are based in Ausgrid, Endeavour Energy and Essential you can read more about what increases to expect here.

After you have received your rate increase notice we strongly encourage you to compare the new contract against other energy suppliers to ensure you are on a competitive deal. What’s more, work with an expert like Choice Energy who can compare business electricity prices for you.

To help soften the blow, as part of the Federal Government’s energy bill relief, eligible small businesses in New South Wales will benefit from a $650 rebate. Read about it here on energy.gov.

Commercial Solar & Solar For Business

Queensland electricity insights

Large-market

Callide C Power Station in Queensland was due back online in October 2023 after a mysterious explosion in 2021 saw a “temporary” shut down.

The Power Station’s return has now been delayed until mid 2024. As reported in the AFR, “The decision is expected to put pressure on wholesale power prices for the rest of the year and test the capacity of the energy grid to cope over the hot summer months.” Read the article here.

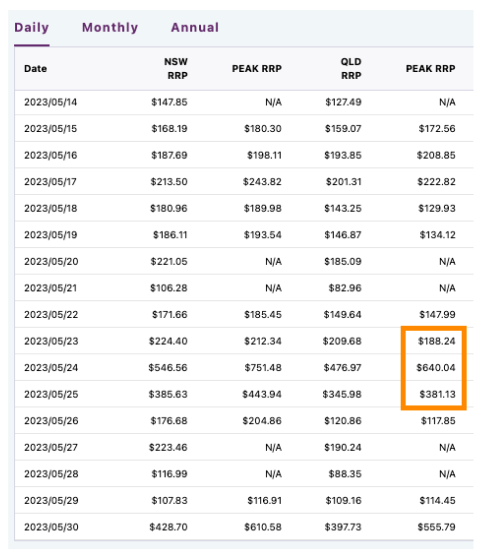

Threat of supply shortages and price volatility was shown on 24th May, when the spot price reached $640.04 / mWh.

Queensland rates are also continuing to climb and the trend is expected to continue.

If your business is coming out of contract within the next 6-12 months, a review of rates would be advisable. A shorter term extension may also be advisable depending on the business’s scenario.

Source: QLD Base Cal Futures, source: ASX Energy, 14 June 2024

Small-market

As part of the Default Market Offer determination, small businesses in Energex should receive a rate increase notice over the months of May - July, highlighting a potential increase of up to 21.9%. Read more

Set by The Australian Energy Regulator, the main way to soften these increases is to compare electricity prices yourself or work with an energy solutions business like Choice Energy who can do this for you, hassle free.

In better news, eligible businesses will benefit from a $650 payment as part of the Federal Government’s Energy Bill Relief Fund for small businesses.

Ergon

For those in the Ergon region, the Queensland Competition Authority (QCA) released the regulated retail electricity prices (notified prices) to apply in regional Queensland in 2023–24.

Typical customers on all major tariffs can expect an increase in their electricity bills in 2023–24, largely due to an increase in wholesale energy costs and (to a lesser extent) other cost components.

Typical customers on the main small business tariff (tariff 20) can expect to pay around 26.8 per cent more for electricity in 2023–24.

While large business customer on tariffs 44, 45 or 46 can expect to pay around 7.5 to 16.7 per cent more for electricity in 2023–24.

Full details of the price increases and QCA reports including technical data can be downloaded on the QCA website.

We strongly encourage all Ergon customers to explore solar as a way to reduce their reliance on the energy grid.

South Australia electricity insights

Large-market

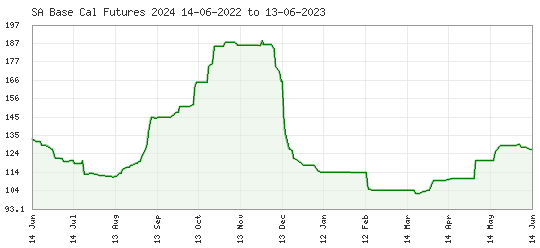

While South Australian wholesale prices are far less than the period of October - December 2023, they have been on the rise since mid-March 23 and the trend is set to continue.

Source: SA Base Cal Futures, source: ASX Energy, 14 June 2024

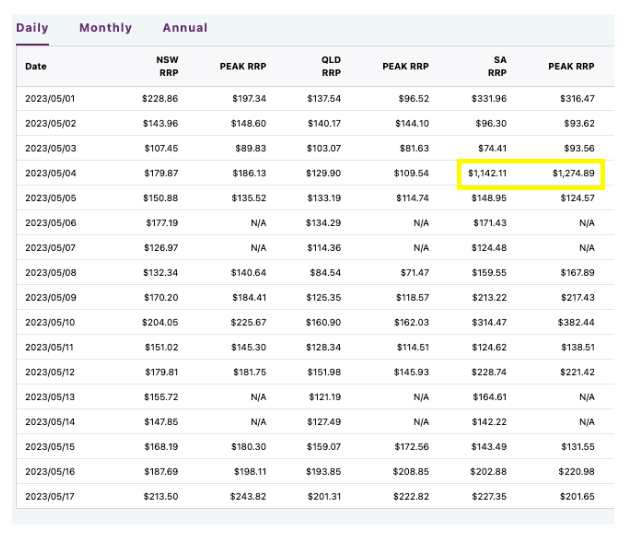

As indicated in the chart below, prices spiked throughout May, and the volatility in South Australia with no coal generation was evident as spot prices reached $1,124 / mWh.

Right now, there is less retailer competition in South Australia which isn’t helping with competitive pricing for SA businesses. This is largely due to Retailer Reliability Obligation (RRO) pressures with retailers “filling their book”, as we get closer to March 2024.

A review of rates would be advisable for any business coming out of their electricity contract in the next 6 - 12 months. A shorter term extension may also be advisable depending on your situation.

Small-market

As part of the Default Market Offer (DMO) determination by the Australian Energy Regulator, eligible small businesses in South Australia should prepare to receive a rates notice highlighting an annual increase of up to 28.9%, accounting for the increased costs of supplying electricity to consumers.

Businesses are reminded the DMO is not a competitive price but is instead supposed to act as a reference price, and therefore, shopping around for competitive electricity prices is encouraged. Choice Energy can work with you to do this for you: https://www.choiceenergy.com.au/compare-electricity

To help ease the pressure, eligible businesses will soon benefit from a $650 payment as part of the Federal Government’s Energy Bill Relief Fund.

Tasmania electricity insights

Large-market

Making noise in the media right now is the potential construction of the Marinus Link, which is the creation of two new HVDC cables connecting Tasmania and Victoria.

The purpose of Marinus Link is to provide excess supply from Tas Hydro to the mainland, and renewable power generation from Victoria to Tasmania in times of need.

Naturally, there are conflicting opinions about whether the project should go ahead - but the promoted benefits to Tasmanians seem to be lower energy costs.

According to Marinus Link chief executive Bess Clark, "the interconnectors could lead to the average Tasmanian customer paying about $40 a year more in network charges but result in energy prices lowering by more than $100 a year."

Each of the three governments will take on an ownership share of the completed project.

Generally, Tasmanian wholesale energy prices remain high. In many cases, there is less retailer competition and prices are largely affected by challenges that supply power.

A review of your energy rates would be advisable for your business electricity contract is set to expire in the next 6 - 12 months. A shorter term extension may also be advisable depending on your business’s scenario.

The Tasmanian Government is offering a one-off payment of up to $20,000 to eligible businesses in fixed electricity contracts as part of their Large Business Customer Electricity Support Scheme. Read more here.

To be eligible, Tasmanian businesses must:

Hold an active Australian Business Number (ABN).

Have a business located in Tasmania and employ at least 80% of its staff in Tasmania (by Full Time Equivalent at the time of the application).

Have executed a new fixed price electricity agreement in the period between 1 April 2022 and 30 June 2023, with an annual contracted consumption greater than 150 Megawatt hours (MWh), in line with the criteria within the guidelines.

Have a new fixed price agreement that has a higher weighted average price than the previous agreement.

Have experienced, or are expected to experience, financial strain as a result of the increase in weighted average price in electricity and be able to demonstrate this financial strain.

Eligible businesses will receive a payment of up to $20,000 for 80 per cent of the difference between their new weighted average electricity price and a reference rate of $87.96 per MWh, covering their contract period.

Applications for the scheme will close at 5.00 pm on 31 July 2023.

Small-market

Businesses on small market contracts are experiencing similar energy increases to the mainland and limited retailer competition with only three energy suppliers on offer - Aurora, First and Energy Locals.

Small businesses are encouraged to explore the viability of commercial solar for their site, if they are spending more than $400 per month. You do not need to own the building you operate in.

Choice Energy can run a feasibility assessment to see if solar can be cash flow positive or neutral from day one.

To help lessen the impacts of these price increases, as part of the Federal Government’s energy bill relief, eligible small businesses in Tasmania, will benefit from a $650 rebate. Read about it here on energy.gov.

National gas insights

The gas market looks volatile than ever. Gas prices are still high compared to 24 months ago.

Labor has extended its price caps on gas until 2025, with exemptions. The exemptions mean that the price cap is not set for all gas, indicating volatility is still expected.

Tendered gas pricing is cheaper than the 2022 Calendar year.

Any business who contracted their gas last year, would be advisable to have a fresh review done to consider options into 2024 and 2025.