Liddell. Hazelwood. Loy Yang and Bayswater. And now, Origin Energy has announced their intention to move the closure of NSW’s largest power station forward by seven years.

What’s going on in the energy market? And more importantly: How could this trend of early station closures impact you as a business?

Why so many closures?

While common enough in their ability to produce energy from brown and black coal, the majority of power stations powering the National Energy Market (NEM) in Australia have met their end for a diverse array of reasons. For some, like Yallourn, the closure is a drastically avoided retirement, with the station built in 1921 with an intended lifespan of only fifty years. Its subsequent move from 2032 to closure in 2028 is more a reflection of risk management than of a move to a greener future.

But what about the risk of blackouts and crises? In 2015, AGL announced the intent closure of the Liddell power plant at the end of 2022, with this decision changed in February last year to 2023 as a means to prevent said blackouts and crisis.

Risk management, of course, remains the central guiding light for many, but more for the back pocket of these major energy players. Ultimately these closures are a reflection of profit loss in an industry where cheaper and flexible greener options are quickly outstripping these ancient power stations, designed for a bygone era. To stand beside stations that continue to break, explode and generally require incredibly costly maintenance is simply bad business.

The biggest risk of all

While the closure of polluting and inflexible coal power stations may seem net positive from an environmental stance, we still face an ongoing concern that continues to teeter on the brink of crisis without further station closures needed: What will provide the energy for our growing population’s demands?

The announcement by Origin Energy of their intention to close NSW’s Eraring facility is perhaps one of the few that have immediately been followed by a continuity strategy. Eraring is Origin’s only coal-fired power station, with the company already utilising a combination of gas and renewables, but with this announcement comes the “well-progressed” plan to create a 700 megawatt storage battery on the site. According to NSW energy minister Matt Kean, this will “free up capacity in our transmission system, and that will enable users to access more of our existing supply”.

While this statement is confident, Federal Energy Minister Angus Taylor is not so convinced: "The early and sudden closure of this 2880 MW generator will leave a considerable gap in reliable generation in the National Electricity Market, representing more than 20 percent of NSW generation output," he said in a statement.

Politicking aside: What’s the reality? And how is it going to affect the everyday business owner and energy user?

How this could affect energy users

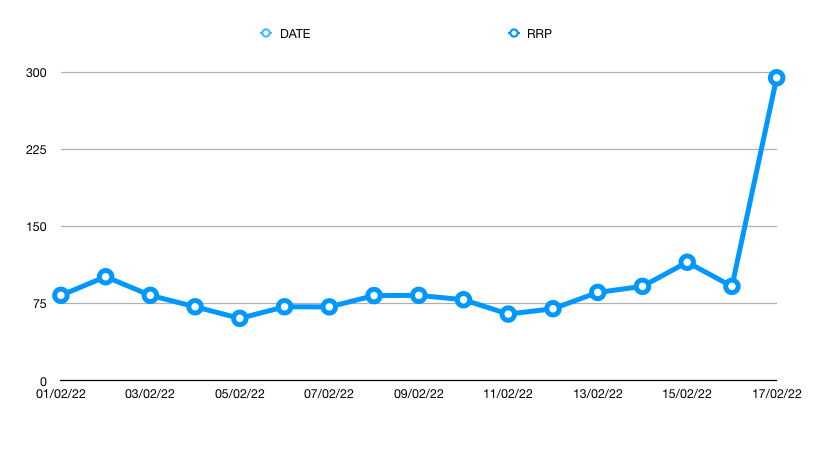

With news only recently announced, the market has responded with wholesale markets climbing over 10% already, on top of costs currently at a two year high - not to mention a knock on effect to interconnected Queensland.

Chart showing price and demand data 01/02/22 - 17/02/22 readings at 23:45. Info source: AEMO Aggregated Price and Demand Data

Like all markets, confidence is key, and wholesale energy is no different. Set amongst the early closures of so many other NEM stations, not to mention breakdowns and explosions, plans for a like-for-like replacement of energy need to be solid, actionable and timely. When energy providers fail to show this, or receive critique from other key influencers in the space, the market has the potential to react accordingly.

And this cynical response stems from experience. When the Hazelwood plant closed in 2017, Victorians saw an increase in energy costs as Hazelwood took with it 20% of the state’s energy output, matched with a sluggish response to this deficit. Even then, support between state and federal governments show how this crucial utility can fall prey to policy antics.

So how does a business protect themselves against a lack of surety?

While the interruption to energy demand saw low costs throughout the coronavirus lockdowns, we are gradually seeing a return to higher costs, and in combination to yet another closure and energy manufacturing flip, forecasting your business costs is difficult at best.

Energy management solutions with Choice Energy allow us to not only assess your needs right now, but also find an optimised energy agreement that can lock in rates for a range of periods, creating surety around your upcoming energy expenses. Combined with tariff demand analysis, metering and monitoring, we are here to create powerful opportunities that keep confidence high and your energy needs accurate through these coming years. Best of all? We take the hard work off your plate with a dedicated Choice Energy specialist taking care of your needs.

Likewise, an investment in commercial solar offers many businesses a solution that may negate grid energy fluctuations. Your high quality system creates an independent source of energy that not only reduces your grid energy costs, but also improves your sustainability profile. You can learn more about our strategic commercial solar offerings here.

Unsure of what you need? Call us on 1300 304 448 or send us a message here to learn more.