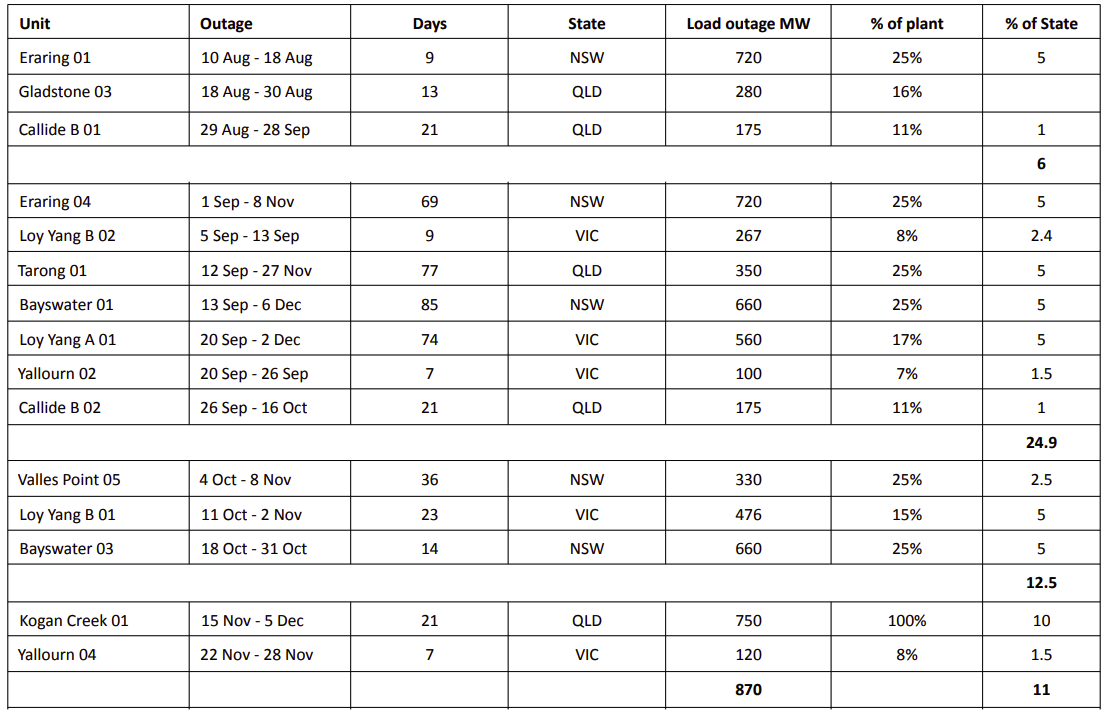

Between August and December 2025, multiple major coal units across NSW, QLD, and VIC will go offline for weeks at a time, which will significantly reduce available generation across the grid. Collectively, these outages represent thousands of megawatts of reduced generation, increasing the risk of price volatility as demand rises.

Over 6,000 MW of capacity will be impacted across NSW, VIC, and QLD over this period.

Why This Matters

When multiple large generators are offline at once, the grid has less spare capacity. This makes the system more reliant on higher-cost gas generation and imports, a pattern seen during the 2022 energy crisis, when unplanned outages and high gas prices sent wholesale electricity costs soaring.

The 2022 Energy Crisis Unpacked

In 2022, Australia’s energy market was hit by a combination of global and domestic shocks. Russia’s invasion of Ukraine triggered an international fuel shock, driving up global coal and gas prices, which flowed into domestic wholesale electricity costs due to Australia’s exposure to export markets. At the same time, La Niña related flooding in coal producing regions and outages at major coal fired power stations constrained supply, worsening the crisis. The Australian Energy Market Operator (AEMO) was forced to suspend the spot market, taking direct control of generation and dispatch for the first time in NEM history. The outcome was sharp wholesale electricity price spikes, wholesale prices rose by approximately 141% in Q1 2022 compared to Q1 2021. These soaring costs translated into up to 25% hikes in household electricity bills, while businesses were also heavily impacted, with many facing sudden increases in operating costs, reduced profit margins, and unexpected contract price rises that forced some to scale back production or pass costs on to customers.

What it means for 2025

The experience of 2022 is a clear warning sign for what businesses could face later this year. The market’s reliance on gas fired generation and imports, when coal was unavailable, highlighted how vulnerable the system becomes when multiple large units are offline at once.

With over 6,000 MW of coal capacity scheduled to be out of action between August and December 2025, the market risks falling into a similar pattern. While global conditions may differ, the structural challenge remains the same. So, when coal plants are offline, the grid leans heavily on higher cost generation assets, increasing the likelihood of sudden price spikes. Businesses that failed to secure contracts early in 2022 were caught paying dramatically higher rates as the crisis unfolded.

The outages scheduled this year may not replicate the exact conditions of 2022, but the risk of heightened volatility is real.

What Businesses Should Do Now

To get ahead of the upcoming outages, businesses should act now to protect against potential price spikes. Securing a new energy contract before the outages begin can help avoid exposure to rising spot and retail contract prices. It’s also a smart time to review your energy plan, especially if your current contract is set to expire within the next 12 to 18 months.

While the exact conditions of the 2022 energy crisis may not repeat, the lesson is clear: Reduced grid capacity often drives wholesale prices higher, putting unprepared businesses at risk of increased energy costs.

Now is the time to take control. By working with Choice Energy, your business gains the advantage of forward planning. Our team actively monitors market conditions and negotiates contracts at the right time, helping you secure competitive rates before volatility takes hold.